Tax Structures: Types & Concept

Do you love earning but hate that a vast percentage of your income goes into the government’s pocket every year? Understanding the various tax structures and their types can help you reduce your income tax rate and enjoy more hard-earned money.

Everything you need to know about tax structures, their types, and concepts.

Various Types of Tax Structures-

Tax structures are the ways that the Australian government can apply tax rates through the Australian Taxation Office (ATO). Taxes are levied in three ways: progressive tax, regressive tax, or proportional tax. Let us learn more about each of them.

#1- Regressive tax structure

The regressive tax structure shifts the burden of taxation towards the low-income earners within society. Low-income individuals pay a higher income tax percentage, while high-income individuals pay less. However, each government can define income differently and accordingly levy taxes on them. For instance, your income from investments may attract a lower tax rate than your income from wages or salary. This way, you may pay less taxes if your government also offers a preferential tax rate on investment incomes and you use them in your favour.

#2- Progressive tax structure

The progressive tax structure is opposite to the regressive tax structure. The burden of taxation is focused towards high-income earners. In other words, the tax rates, and hence the tax payable, will increase with the increasing income. Therefore, the more you earn, the higher the tax rates you pay.

#3- Proportional tax structure

The proportional tax structure does not depend on the taxpayer’s income level. A proportional tax structure is a flat tax rate equal for everyone despite their income. So, in theory, the proportional tax structure should create a similar taxation burden on every member of society, whether they are high or low-income earners. State income taxes and most sales taxes are examples of the proportional tax structure.

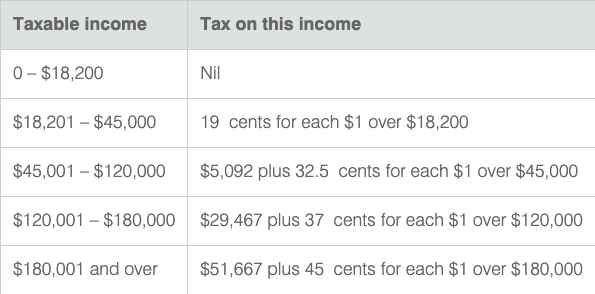

The Australian taxation structure is progressive. Therefore, the system aims to increase taxes based on income earned by individuals, focusing on high-income earners paying increased tax rates. However, it is important to note that according to the ATO, an individual can earn up to $18,200 in a financial year and not pay any tax. This is known as the tax-free threshold.

See below for Australian resident tax rates:

Statistics taken from ATO: visit https://www.ato.gov.au/rates/individual-income-tax-rates/ for further information.

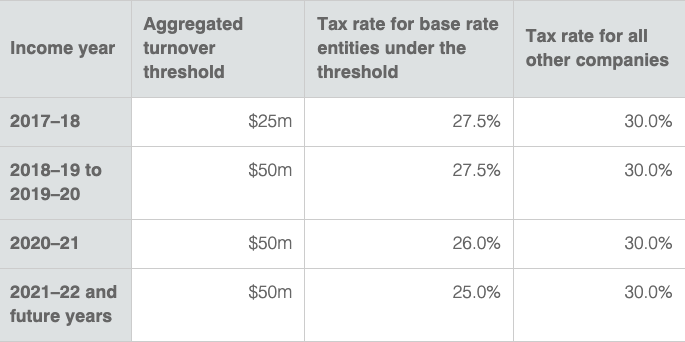

Conversely, business owners are required to pay a full company tax rate of 30%, which applies to all companies that are not eligible for the lower company tax rate. These rates are based on aggregate turnover for that income year, and that this is less than the aggregated turnover threshold for that income year.

See below for Progressive changes to the company tax rate:

Statistics taken from ATO: visit https://www.ato.gov.au/rates/changes-to-company-tax-rates/ for further information.

Ensuring you adhere to all Australian taxation laws and regulations can be a time-consuming and confusing task. This is why choosing an accountant, and financial advisor you trust is vital. Sphere Accountants and Advisors ensure that all your tax requirements are met to protect yourself and your business each year.

About Sphere Accountants & Advisors-

If you are seeking advice on protecting your assets, your search ends with Sphere Accountants and Advisors. Through working with Sphere Accountants and Advisors, we consider the complete picture and continually look for ways to improve your financial situation to create, protect and grow your wealth. We apply this approach whether you come as an individual or a business. With a breadth of expertise spanning all aspects of taxation, accounting, financial planning and more, we can offer a complete solution for all your financial needs.

Our services include accounting and taxation, advisors, financial planning, lending and finance, bookkeeping, and self-managed super fund. The Sphere Group is also CA and CPA Accredited.

Visit our website, call us at (03) 8899 6399, or email us for more details.