If you are an owner of a rental property in Australia, the ATO has released a guide that may help you determine things such as:

- which rental income is assessable for tax purposes,

- which expenses are allowable deductions,

- which records you need to keep and

- what you need to know when you sell your rental property.

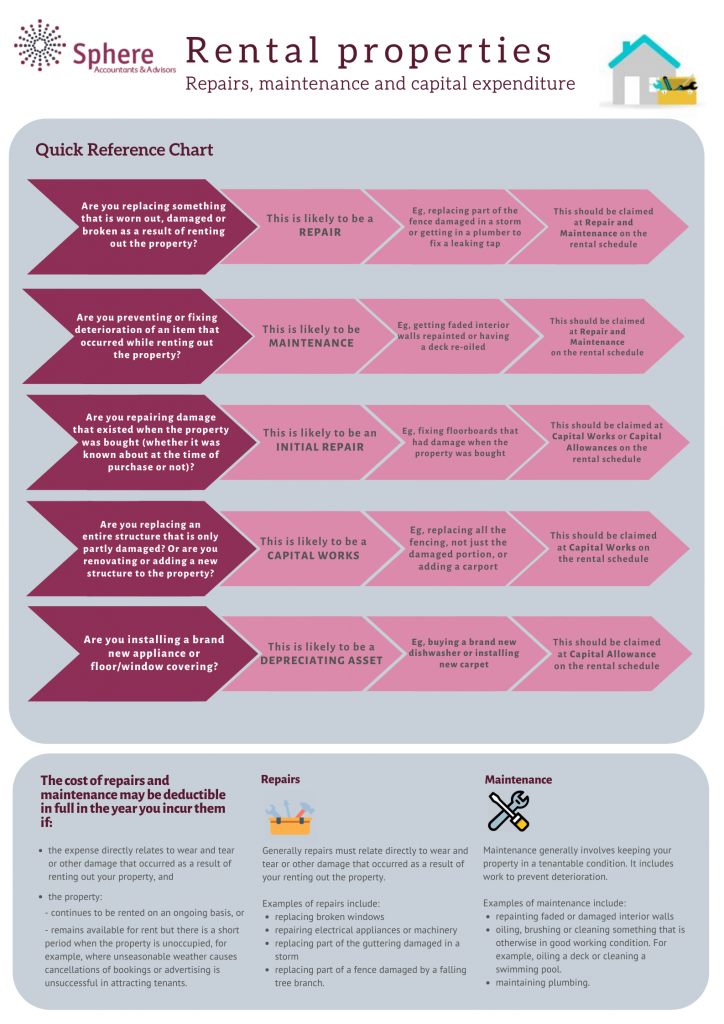

Many, but not all, of the expenses associated with rental properties will be tax deductible.

This guide explains things like:

- how to apportion your expenses if only part of them are tax deductible

- what expenses are not deductible

- when you can claim those expenses that are deductible

- some you can claim in the tax return for the income year in which you spent the money

- others must be claimed over a number of years (including decline in value of depreciating assets and capital works expenses).

Need help with your rental properties? Contact the Sphere Group Team now and we are here to make your lives easier.

You can also download the Rental Properties 2019 Guide here: Sphere Accountants – Rental Properties 2019 Guide Summary.

For more information go to ato.gov.au/rental.